Breaking News

Finance

UK Inflation Expectations Hit Pre-Rise Levels As BOE Takes Charge

Leo Gonzalez

March 15, 2024 - 11:56 am

UK Inflation Expectations Plunge to Pre-Hike Levels Amid BOE's Vigilant Measures

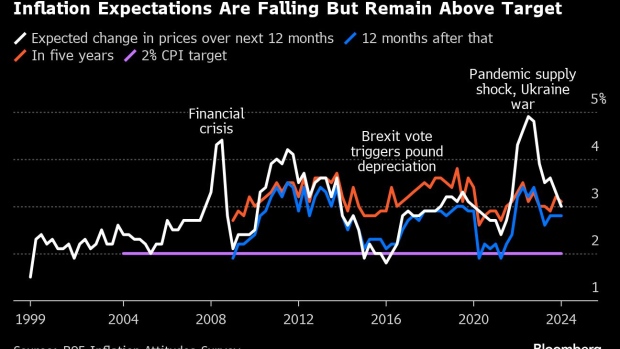

In a striking sign of progress, the United Kingdom's residents are now foreseeing a slowdown in the rate of inflation, with expectations sagging to their lowest point since the late summer of 2021. This significant drop arrives just before the Bank of England (BOE) initiated an assertive cycle of interest rate hikes aimed at reigning in runaway prices, underscoring the central bank's persistent efforts to stabilize the economy.

Survey Revelations: Inflation Expectations Ebb

A survey conducted in February reveals that households within the UK predict a 3% price rise over the next 12 months, a dip from the 3.3% expected back in November. These findings were part of the BOE’s quarterly Inflation Attitudes Survey, which has importantly highlighted the lowest anticipation of inflation since August 2021, a prelude to the bank's decision to raise interest rates through 14 consecutive hikes to tackle the inflation highs.

While short-term outlooks have improved, the longer-term forecasts remain consistently steadfast. The survey showed that the expectations for the year starting from February 2025 hold steady, with inflation forecasts remaining entrenched at 2.8%.

The Battle Against Inflation

The survey's outcomes hint strongly at the BOE's success in anchoring inflation expectations even amid what has been the most severe squeeze on living costs for multiple generations. This facet is critical; the rate at which inflation is predicted to accelerate has direct bearings on the wage demands workers set forth and the pricing strategies businesses employ.

In an effort to combat the inflation surge, the central bank took action in December 2021, raising interest rates to a current high of 5.25%, thereby signaling its commitment to economic stability. However, as inflation shows signs of a steep decline in 2023, the bank is cautiously inching towards a rate cut. Economists project that inflation rates will soon fall beneath the BOE's 2% target in the upcoming months. Despite this, the central bank continues to approach the notion of reducing rates with caution, especially given the enduring vigor of wage growth and the persistent inflation within the service sector.

Boons of the Improving Inflation Outlook

As expectations align more closely with the reality of easing inflation, the public's confidence in the Bank of England is witnessing a resurgence. This rebound comes after confidence cratered to historic lows during the double-digit price increases. The net balance indicating British citizens' satisfaction now reads at minus 5, up from minus 14, marking a gradual recovery from the dismal troughs preceded by the inflation spike.

Still, today's levels of satisfaction lag behind those seen in pre-inflationary periods, indicating the long road ahead for the BOE to fully restore public trust.

Tensions and Criticisms Amid Price Pressures

The struggle to rein in the spiraling cost pressures has engendered a significant downfall in public trust in the BOE and resulted in a barrage of criticisms from political corners. The strained relationship between the central bank and the government came to light in a piece penned by senior Conservative MP David Davis, published in the Daily Telegraph newspaper.

David Davis, who has served as a former Brexit Secretary, advocated for a radical shift in the operational dynamics of the BOE. He proposed that the independence granted to the bank by the Labour government in 1997 should be revoked. In his column on Thursday, Davis contended there was no clear evidence that the decisions taken by the BOE post-independence outstripped the judgment calls in the era preceding Labour's rise to power. He reminisced about the times when figures like Margaret Thatcher and Nigel Lawson at the helm purportedly made superior decisions than subsequent governments did post the establishment of the bank's independence.

The Legacy of Operational Independence

The operational independence of the Bank of England, bestowed over two decades ago, marked a pivotal shift aiming to insulate monetary policy decisions from political influence and short-term electioneering strategies. The separation intended to provide a stable foundation for monetary policies that would be shielded from the whirlwinds of political change.

However, the recent turmoil accompanied by high inflation rates has sparked discussions over the effectiveness of the BOE's autonomy. While some laud the distancing of monetary policy from political exigencies, others question whether the independence of the bank truly translates to more effective economic decisions.

BOE's Monetary Policy Stance

The Bank of England's approach to the increasing financial pressures has been firm and agile. By embarking on the most aggressive spate of rate raises, the central bank sought to mitigate the high inflation that could otherwise entrench into the economy’s fabric.

The approach has been aligning with classic economic thinking, which expounds that proactive and decisive action on inflation can prevent a spiral of escalating costs and depletion of purchasing power. By raising interest rates, the bank aimed to cool off consumer demand and curb inflation expectations, thus steering the economy away from a persistent inflationary environment.

Reflections on Past Economic Strategies

The commentary from David Davis harkens back to the era of Thatcherism and its focus on tight-fisted monetary policies as a fundamental component of economic management. He reflects on the legacy of former Prime Minister Margaret Thatcher and her Chancellor of the Exchequer Nigel Lawson, implying that their strategies may have been more effective despite sporadic volatilities during their tenure.

Moving Forward in Monetary Policy

As the UK weathers the repercussions of the economic volatility and the BOE continues to adjust its policies in response to shifting inflationary patterns, the importance of maintaining a forward-looking approach to monetary policy becomes evident. The central bank faces the challenge of balancing the need for economic growth against the necessity to maintain price stability—a scenario that requires precision and foresight.

With public opinion on monetary policy remaining divided, the BOE's strategy appears to be reaching a decisive juncture. As the economy gears up for the next phase, where the possibility of rate cuts looms, gauging the optimal timing for such adjustments is crucial for safeguarding the economy's recovery trajectory.

Conclusion

The insights from the BOE's recent survey and the attendant discourse illuminate the complexities that define the UK’s current economic landscape. With inflation expectations waning, trust in the BOE inching up, and yet skepticism lingering amongst certain political ranks, the United Kingdom stands at the crossroads of its financial future.

The decisions ahead will determine not just the trajectory of the nation's economy but also the role of its central banking institution in an ever-evolving global context. As for now, the tale of inflation's taming by the Bank of England continues to unfold, with the nation cautiously optimistic about the path that lies ahead.

©2024 Bloomberg L.P.

Please visit Bloomberg for further details on this topic: BOE Inflation Attitudes Survey

saving scoop business© 2024 All Rights Reserved